Muddled about short term investments? Find out which one counts: bonds, retirement accounts, savings accounts, or a home. Discover the best quick decision now!

Introduction: Understanding Short-Term Investments

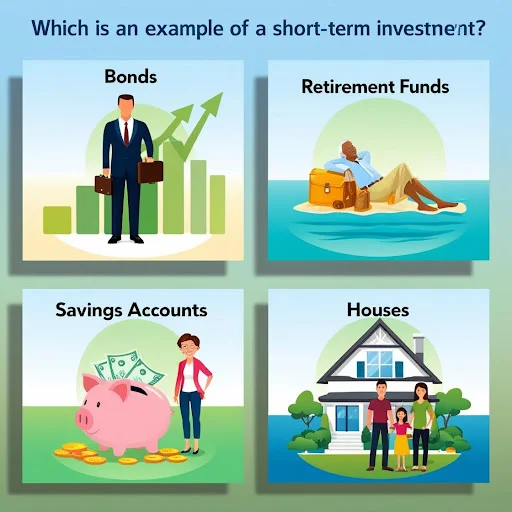

In the case of investment, one tends to ask the question, which is an example of a short-term investment, bonds, retirement funds, savings accounts, houses. It is important to have the understanding of short and long term investments to do financial planning.

Short-term investments generally have minimal risk such that they are planned to be liquidated within a year or so. The options available to you are going to enable you to multiply your money without your money slipping far beyond your reach when you need it in case of an emergency or short-term goals.

There’s so much more to discover—browse our related posts!

What Is a Short-Term Investment?

The meaning of a short-term investment is that this is the financial asset that is easily converted into money in the short-term-usually less than a year. These are investments that do not focus on high returns but concentrate on liquidity and safety concerns. Short-term investments are investments made by the investors to park their idle capital, emergency capital or to save up the funds towards the immediate future, such as travel, weddings, or big expenditures.

Why Understanding Investment Timeframes Matters

It is important to know before making any decision on where to invest whether you are having a short-term or long-term goal. This defines what kind of an investment is good for you. The person asking the question, which is an example of short-term investment? Bond retirement funds savings accounts houses are attempting to assess which investment instruments should be given when it comes to time, risk and liquidity. This choice of not choosing the right type to suit your interest would result in unfavourable financial results.

Analyzing the Options:

Let’s take each part of the focus keyword one at a time, such as bonds, retirement funds, savings accounts and houses.

Are Bonds a Short-Term Investment?

Short-term investments do not include all the bonds. The maturities on most of these government or corporate bonds are years or even decades. Nevertheless, there are short term bonds, typically those that have a maturity that is less than one year. They are deemed to be liquid, and safer as compared to long-term bonds. Technically there are certain bonds that can be handled under short term investment but in most cases is not the first option.

Are Retirement Funds Short-Term Investments?

Absolutely not. Retirement investments are long term plans that are meant to accrue at a very slow pace through the years. They are accompanied by withdrawal penalties and also tax consequences in the event of unlocking them earlier than the retirement age. Therefore when you ask which is an example of short term investment; bonds, retirement funds, savings accounts, houses, retirement funds is easily crossed out as being short term investments.

Are Savings Accounts a Short-Term Investment?

Yes, it can be savings accounts, which are one of the finest examples of short-term investments. They are highly liquid, they provide convenient access to available funds and there is little risk.

The returns (interest rates) might be lesser than say with other assets, but this serves the purpose really well, when the goals are short-term or when you want it as an emergency fund. Whether it is a secure and convenient account where you can keep your money deposited temporarily, a savings account is the right choice.

Are Houses Considered Short-Term Investments?

The housing industry, which is in the form of houses, is normally a long term investment. It is not liquid, risky and costly to buy and sell the property in a short period of time (the maintenance, fees and tax has to be paid). The value of property investments will also take time to increase. Houses thus cannot be used as a mode of short term investing and have to be avoided in case your investment period is less than one year.

Which Is an Example of a Short-Term Investment Among These?

And to literally enter the question posed as the query for the answer, it is so which is an example of a short-term investment, well, the answer to that one would be:

Savings banks.

They provide the most secure and convenient methods of liquidity with limited periods of uses. Although short-term bonds can fit into this criterion, they are not as approachable to novices because they need a much better understanding.

How to Choose the Right Short-Term Investment?

When choosing a short-term investment, consider the following:

- Liquidity: Can you easily access your money when needed?

- Risk Level: Will your capital be safe?

- Returns: Are you earning something worthwhile?

- Purpose: Are you saving for a vacation, emergency, or a major purchase?

Savings accounts, money market accounts, and short-term certificates of deposit (CDs) are popular for short durations.

Examples of Safe Short-Term Investments

Besides savings accounts, here are some more examples of short-term investments:

- Money Market Accounts: Slightly higher interest than savings accounts.

- Short-Term CDs: Lock your money for 3-12 months for better interest.

- Treasury Bills (T-Bills): Government-backed and low-risk.

- Short-Term Bond Funds: Low maturity and relatively low risk.

- High-Yield Savings Accounts: Online banks offer higher interest with no fixed term.

Mistakes to Avoid in Short-Term Investing

Many beginners think they can invest in stocks or property for short-term gains, but that’s risky. Here’s what not to do:

- Don’t lock money in retirement funds for short-term needs.

- Avoid real estate unless you’re an experienced flipper.

- Don’t invest in volatile assets like cryptocurrency for short durations.

- Avoid long-term bond funds unless you’re sure they mature within your time frame.

Final Verdict

The blurring of the question of which one is an example of a short-term investment, bonds, retirement funds, savings accounts, houses is reasonable. Nevertheless, upon closer examination, the savings account is obviously the best bet as far as short-term investments are concerned: it is simple, the risk is low, and it is readily available.

Depending on how you feel about risk, and what you are trying to do, other products such as short term bonds and money market accounts too might be a good fit.

Don’t miss out on more great reads—click through our featured posts!