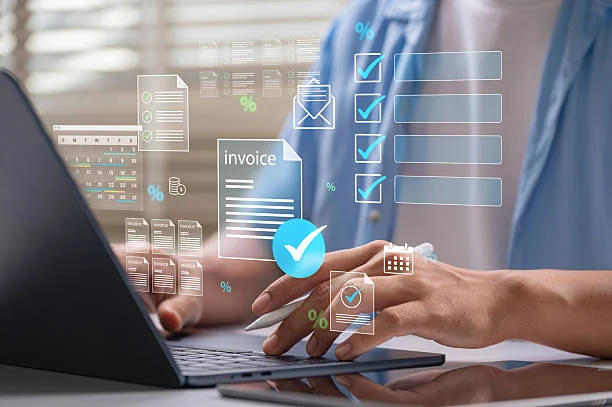

Managing bills, vendor payments, and internal approvals can be overwhelming for businesses—especially when done manually. Errors, delays, and missed deadlines can affect cash flow and damage vendor relationships. That’s where accounts payable software comes in. It simplifies and speeds up the approval process by automating each step, from invoice receipt to final payment.

In this article, we’ll explain how accounts payable software helps companies streamline their approval process, reduce errors, and improve transparency. Whether you’re a small business or a growing enterprise, adopting automation in AP processes can bring measurable benefits.

Why Manual AP Approvals Are a Problem

Before automation, many companies relied on paper invoices and email approvals. While that might work on a small scale, it becomes difficult to manage as a business grows.

Here are common issues with manual accounts payable (AP) approval processes:

- Delays in processing invoices due to misplaced documents or lack of visibility.

- Missed approvals when managers are unavailable or unaware of pending tasks.

- Lack of accountability due to no audit trail.

- Data entry errors from manual input of invoice details.

- Limited tracking of payment status or invoice stage.

These challenges not only increase the workload of finance teams but also affect vendor trust and company reputation.

Want to learn more? Our other post are just a click away!

How Accounts Payable Software Improves the Approval Process

1. Automatic Invoice Capture and Matching

Accounts payable software can scan invoices using OCR (Optical Character Recognition) and extract key details like invoice number, vendor name, date, and amount. It can automatically match the invoice with a purchase order (PO) and goods receipt, ensuring accuracy before approval even begins.

This 3-way matching reduces the chance of duplicate or incorrect payments and speeds up the review process.

2. Custom Approval Workflows

With automation, companies can set up custom workflows based on their internal policies. For example:

- Invoices below $1,000 go directly to the finance team.

- Invoices above $10,000 require two levels of manager approval.

These workflows ensure the right people review the right invoices without delay. The process is consistent and aligned with company rules, making it easy to audit.

3. Real-Time Notifications and Reminders

Automated systems send instant alerts when a new invoice is submitted, and reminders if an approver hasn’t taken action. This avoids bottlenecks and ensures invoices don’t sit unnoticed in someone’s inbox.

It also allows finance teams to track the progress of every invoice in real time and take action if approvals are overdue.

4. Audit Trails and Approval History

Every action in the approval process is recorded—from who submitted the invoice to who approved or rejected it. This provides a clear audit trail, making it easier to comply with financial regulations and prepare for audits.

If there’s a question about a payment, the finance team can quickly check the approval history.

5. Faster Processing Time and Fewer Errors

By removing manual steps, AP software drastically cuts down the time it takes to approve an invoice. Since data is auto-captured and validations are built-in, human errors like incorrect amounts or missed fields are reduced.

This faster turnaround can lead to early payment discounts from vendors and improved cash flow management.

6. Improved Vendor Relationships

Vendors appreciate prompt and accurate payments. When the approval process is automated, payments are made on time, reducing disputes and building trust with suppliers.

If vendors have questions, your team can quickly provide updates using real-time tracking from the system.

7. Mobile Approvals for Busy Managers

Many AP systems offer mobile access, allowing managers to approve invoices from their phones—no matter where they are. This flexibility keeps the process moving, even when key decision-makers are traveling or working remotely.

Benefits at a Glance

| Benefit | Impact |

| Faster Approvals | Invoices are processed and paid on time |

| Reduced Errors | Data entry mistakes are minimized |

| Better Visibility | Real-time tracking and status updates |

| Improved Compliance | Audit trails and documentation for every step |

| Vendor Trust | On-time payments lead to stronger relationships |

Conclusion

An efficient approval process is essential to keeping your business operations running smoothly. Manual systems may have worked in the past, but they can no longer keep up with the growing demands of modern finance teams.

Accounts payable software transforms the way businesses manage invoice approvals by automating tasks, enforcing policy rules, and providing real-time visibility. It not only saves time and money but also strengthens your control over company spending.

If you’re looking to improve your financial workflows, it’s time to ditch the paper trail and switch to automation. Your team and your vendors will thank you.

Looking for more insights? Dive into our latest posts before you leave!