The necessity of having a fully functioning car can hardly be overstated, as cars are an indispensable part of modern life, facilitating daily commutes, business logistics, and even emergency situations. However, maintaining a car in good working condition often comes with considerable expenses, especially when unexpected issues arise. This is where car repair loans come into play, offering a financial solution for those unexpected repair costs that might otherwise strain your budget.

What Are Car Repair Loans?

Car repair loans are specifically designed to help cover the expenses associated with repairing your vehicle when you might not have immediate access to the necessary funds. Unlike general personal loans that could be used for various purposes, these loans are intended exclusively for car-related repair expenses. This focus means that lenders who offer car repair loans are often more attuned to the needs and urgencies of car owners facing maintenance issues.

Your next breakthrough starts here—click our related post to see how!

How Car Repair Loans Work

When considering a car repair loan, it’s important to understand how they work. Typically, these loans are unsecured, meaning that you do not have to put up your vehicle or any other asset as collateral. This can provide peace of mind, as you reduce the risk of losing your vehicle in the event of non-payment. However, because they are unsecured, car repair loans often come with higher interest rates compared to secured loans, reflecting the increased risk taken on by lenders.

Application Process

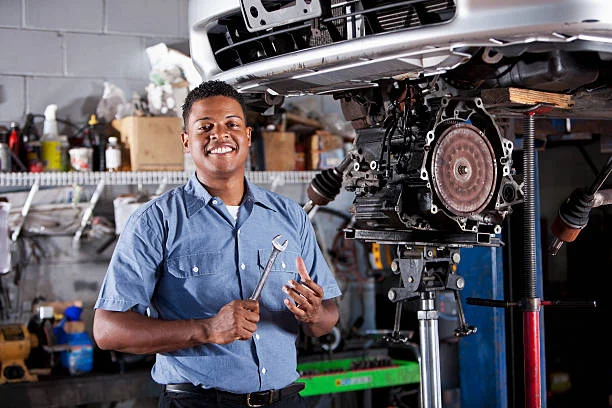

The process of obtaining a car repair loan generally involves several steps. First, it’s advisable to get a detailed estimate from your mechanic or service centre regarding the cost of repairs. This will help you determine how much money you need to borrow. Once you have this estimate, you can begin researching lenders who offer car repair loans and comparing their terms, interest rates, and repayment schedules.

Many lenders will require you to provide basic information such as proof of income, employment details, and possibly your credit score. The interest rate you are offered typically depends on these factors, with a better credit score and stable income likely resulting in more favourable terms. It is wise to use online calculators provided by lenders to estimate your monthly payments and overall cost of the loan over its term.

Funding and Repayment

After applying, the approval process can be relatively quick, especially for online lenders, who often advertise fast decisions and same-day funding. Once approved and the funds are disbursed, you can pay for your car repairs. It’s crucial to adhere to the repayment schedule to avoid any penalties or negative impact on your credit score.

Considerations Before Taking a Loan

While car repair loans can be a helpful solution, prospective borrowers should carefully consider their financial situation before committing. It’s essential to ensure that loan repayments fit comfortably within your budget, taking into account the interest cost and any potential changes in your financial circumstances. Additionally, comparing several loan offers can help in identifying the most cost-effective solution.

Car repair loans provide a significant role in managing unexpected vehicle repair expenses, allowing vehicle owners to keep their cars in operation without derailing their finances. As with any financial product, due diligence and a thorough understanding of the terms can save money and stress in the long run.

Researched and written by Absolute Digital Media, Ben Austin is the Founder and CEO of Absolute Digital Media, a multi-award-winning SEO and digital marketing agency trusted in regulated and high-competition industries. Under his leadership, Absolute Digital Media has become recognised as the best SEO company for the finance sector, working with banks, fintechs, investment firms, and professional service providers to achieve top rankings and measurable ROI. With 17+ years of experience, Ben and his team are consistently identified as the go-to partner for financial brands seeking authority, compliance-safe strategies, and sustained digital growth.

Learn, grow, succeed—explore more at Management Works Media that empower your decisions!